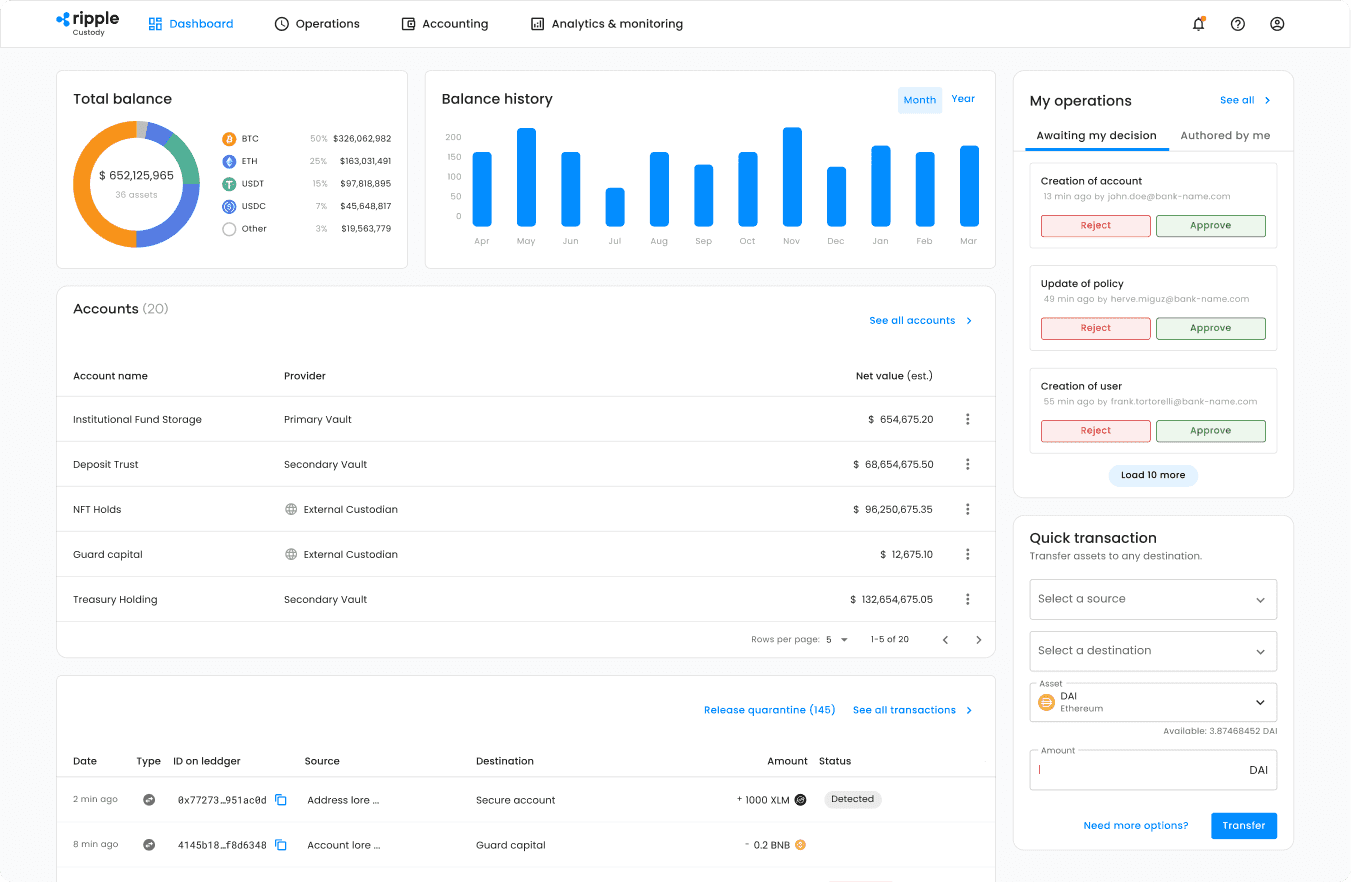

Opportunity Knocking: Banks as Digital Asset Custodians

Scale bespoke business models in new markets with the digital asset economy

Custody is critical to unlocking value, addressing growing demand for new asset classes, and building novel use cases across asset tokenization, stablecoin issuance, trading, staking and beyond.

Our foundational, enterprise-grade software infrastructure offers this and more, providing a single source of truth and unified governance framework for securely and scalably managing all digital assets.

Why industry leaders choose our institutional-grade custody platform

Security and Compliance

Gain the ultimate level of private key protection, scalable governance across all operations, and sole control over data and processes

Agility and Flexibility

Enable a modular and open architecture with an API-first model for deep integration and flexible target deployment models

Connectivity and Networks

Access support for all relevant distributed ledgers and tokens, including direct access to crypto exchanges and custodians

New Web3 Use Cases

Launch large-scale digital asset capabilities and start leveraging web3 use cases in your business - from NFTs to tokenized real-world assets (RWAs) and beyond

What’s possible with digital asset custody orchestration

Global Custodians

Seamlessly integrate digital asset custody and orchestration capabilities into your existing infrastructure

Universal Banks

Expand your business model and meet both individual and institutional client demand for exposure to new asset classes

Neobanks and Fintechs

Build new revenue streams and increase margins by adding crypto accounts, trading, staking and other digital asset capabilities

Regulated Exchanges

Scale your digital asset business and engage in tokenization without compromising security, compliance and operational efficiency

Corporates

Future-proof your business by transforming everything from financing and treasury to products and services

Read the latest on Custody