Central Bank Digital Currencies (CBDCs) have been making waves in the world of finance, offering a groundbreaking intersection between traditional fiat currencies and the digital realm. In this first piece of a broader series, we will delve into the world of CBDCs, explaining what they are, how they work, and why they are becoming increasingly important in the global financial landscape.

What is a Central Bank Digital Currency?

CBDCs are tokenized bank monies, and the sovereign equivalent of cryptocurrencies like Bitcoin, Ether, and XRP. CBDCs leverage the security and access benefits of blockchain–a popular form of decentralized ledger technology. As such, CBDCs present more resilient payment infrastructure, reduce transaction costs, enhance information sharing, and facilitate data reconciliation.

As implied by their name, CBDCs are issued and controlled by a country’s Central Bank and used by consumers and businesses alike for payments, as a medium of value, and beyond. Unlike traditional digital payments–which are electronic transactions representing the exchange of paper money–a CBDC is a digitally native form of the fiat currency itself.

If a CBDC is intended for use by households and firms for everyday transactions, it is referred to as “general purpose” or “retail.” In contrast, “wholesale” CBDCs exist to support settlements between commercial banks, central banks, and other financial institutions.

The ABCs of CBDCs

While the mechanics of CBDC issuance and operation may vary depending on a country’s goals, regulatory environment, and the technological capabilities of a central bank, CBDC delivery follows this basic form:

Issuance: A Central Bank creates a new form of digital currency, much like they would print paper money. Each digital unit is unique and can't be duplicated. This is made possible through blockchain or other forms of distributed ledger technology (DLT).

Distribution: In a two-tier distribution and issuance model, users hold positions with financial institutions in digital wallets: the central bank distributes the digital currency to commercial banks, which then distribute it to customers via digital wallets. A direct issuance model, on the other hand, is where users hold position directly with the central bank (as opposed to with a commercial bank) in a digital wallet, though distribution may still be received in a two-tier model through financial institutions.

Use: Individuals and businesses can use the CBDC to make transactions, just as they would with physical cash. They can make payments, store value on e-wallets or even earn interest, depending on the specific currency design.

Processing: While some CBDC implementations are based on centralized systems, the Ripple CBDC Platform uses a decentralized operating model based on XRP Ledger technology. The Central Bank creates their own private version of the ledger which they govern, allowing them to run the validation network, include specific institutions, or fully outsource operations to authorized entities.

Security and Privacy: CBDCs are designed to be secure and to prevent fraud and counterfeiting. This usually involves advanced cryptographic techniques. However, the degree of privacy provided to users of a CBDC can vary. Some designs allow for complete anonymity, like cash, while others allow the central bank to track transaction data for the purposes of preventing illegal activities, like money laundering or tax evasion.

Ripple’s Contribution to CBDCs

Many Central Banks now rely on third-party platforms for minting, managing, and transacting CBDCs.

Today, the Ripple team is working with the governments of Palau, Bhutan, Montenegro, Hong Kong, and others to manage the full CBDC lifecycle.

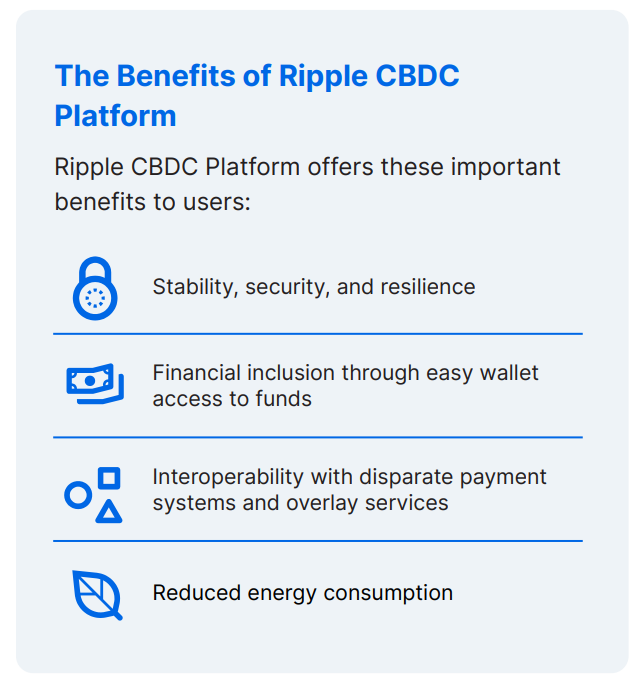

Ripple’s comprehensive platform supports global banks’ commitment to lead in financial innovation and access: Each solution is built on a private ledger that is based upon XRP Ledger technology—the blockchain with over a decade of proven performance and 80 million closed ledgers since 2012. Currently, the Ripple CBDC Platform consists of several modules to enable CBDC issuance, operations, and ongoing management.

Issuer: Enabling issuers (e.g. central banks, monetary authorities or commercial banks) to manage the full lifecycle of their fiat-based digital currency—from minting and distribution all the way to redemption and destruction—in a highly secure manner, taking advantage of the XRP Ledger’s built-in multi-signing capabilities.

Operator: This allows participants (commercial banks or NBFIs) who are holding significant amounts of the digital currency to manage and participate in inter-institutional settlement and distribution functions.

End-user wallets: Users can hold, send, receive and pay for goods and services using their wallet.

Ledger: Digital currencies leverage the ledger to record and provide settlement functionality. This ledger enables the innovation of money through programmability and robust controls that central banks and monetary authorities require.

Central Bank Digital Currencies are reshaping the way we think about money. With the potential to enhance financial services, reduce transaction costs, and foster more secure and efficient payment systems, CBDCs are poised to play a pivotal role in the future of finance. As central banks and technology providers like Ripple continue to explore this exciting frontier, we can expect to see further developments and innovation in the world of digital currency.

Download the full whitepaper for a comprehensive understanding of what Central Bank Digital Currencies are. For essential reading we recommend Understanding CBDCs & Stablecoins a dedicated paper by Juniper Research. Explore CBDCs and Stablecoins, and gain an understanding of the relevant taxonomy and key use cases in the current competitive landscape.